With holiday shopping officially underway, many families are feeling the pressure to find the perfect gifts without going over their budget.

NerdWallet’s 2025 Holiday Spending Report shows the average American plans to spend $1,107 on holiday gifts this season — $182 more than last year — making smart spending strategies more important than ever.

For Kimberly Sneed, a mom in Avondale, Arizona, that planning starts early.

“With three boys at home, we shop early and often for the holidays, to try to get the best deals,” Sneed said.

RELATED STORY | Your holiday shopping could haunt you in January; here’s how to stop it

This year, her kids’ wish lists are driven by top trends.

“The Pokémon cards, I have two boys that collect. So these are top on their list,” Sneed said.

To avoid overspending, she focuses on a balanced approach to gift buying.

“We always like to focus on getting them one large gift, one substantial gift,” Sneed said. “And then just kind of supplementing those to try to rein in that budget.”

She also tracks every dollar.

“Really kind of keeping track of what I'm getting them and making sure that, you know, I've spent similarly on all three,” Sneed said.

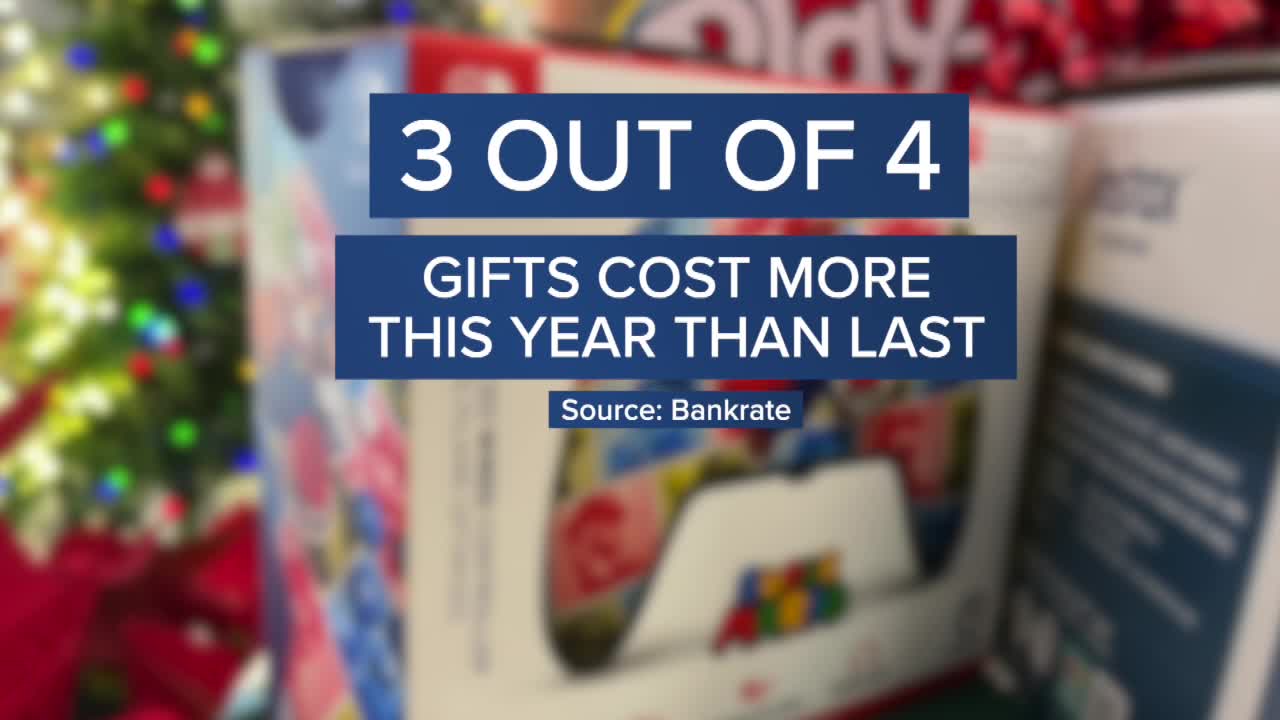

Experts say that kind of discipline is essential as prices continue to rise. New data from Bankrate shows three out of four holiday gifts cost more this year than last.

RELATED STORY | Nearly 1 in 3 Americans expect to slip into debt this holiday season

“That’s what people are feeling. It’s the cumulative effect since the start of 2021; prices are up 25% on average,” Ted Rossman, Bankrate Industry Analyst, said.

Tariffs could also impact shoppers this season.

“Nearly three-quarters of 2025 holiday shoppers expect tariffs to impact their gift shopping,” Elizabeth Ayoola, Smart Money Podcast co-host, said.

Experts recommend several ways to help shoppers stay in control.

Those include shopping early to monitor prices, sharing contact information for targeted offers, using unused rewards points, and only using rewards credit cards if balances are paid off immediately.

NerdWallet finds that 31% of last year’s credit card shoppers still haven’t paid off their holiday debt.

“I think that's a cautionary tale for people still carrying debt to try not to amass more,” Ayoola said.

Buy-now-pay-later programs can also be tempting, but come with risks.

“You want to avoid what's called buy now, pay later loan stacking. So that's when you're taking out multiple loans at once, and it can be difficult to keep up with your spending,” Ayoola said.

The good news for shoppers is that retailers are responding to tighter budgets.

“Retailers are bending on price. They acknowledge that people are feeling pretty frugal...,” Rossman said.

At Walmart, shelves are packed with affordable gift options.

“This is the My Life as Dorothy doll for $39.97. When you compare the My Life dolls to the American Girl dolls, that’s a huge saving for our customer,” Verrinia Kennedy, a Walmart Store Manager in Scottsdale, Arizona, said.

“Every child deserves a Christmas,” Kennedy said.

For Sneed, affordability now means avoiding a financial hangover in the new year.

“Stick to a budget that you know you can afford,” Sneed said. “Then you're not going into January feeling like you overspent.”

This story was reported on-air by Jane Caffrey at the Scripps News Group station in Phoenix, and has been converted to this platform with the assistance of AI. Our editorial team verifies all reporting on all platforms for fairness and accuracy.